Affiliate Disclosure

Plumber Guide Guys is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.

Does Homeowners Insurance Cover Plumbing Leaks Under Slab? Ever thought about what happens if a hidden plumbing leak damages your home’s foundation? Water damage under your concrete slab can be a nightmare. It leaves you worried about repair costs and insurance.

Slab leaks are a big worry for homeowners. These underground pipe breaks can harm your home’s structure if not found early. Knowing if your insurance covers foundation leaks is key to protecting your home.

The answer to whether homeowners insurance covers plumbing leaks under slab depends on your policy and the leak’s cause. Some leaks might be fully covered, while others could cost you a lot of money.

Key Takeaways

- Slab leaks can cause extensive damage to your home’s foundation

- Insurance coverage varies based on the cause of the leak

- Sudden and accidental damage is more likely to be covered

- Regular home maintenance can help prevent possible leaks

- Understanding your specific policy is vital for proper protection

Table of Contents

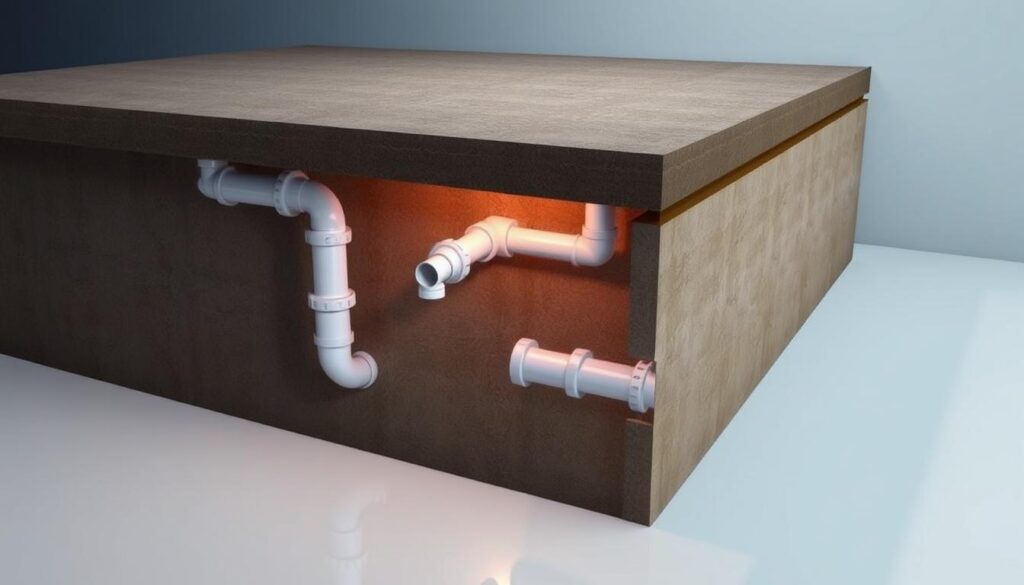

Understanding Slab Leaks and Their Impact on Your Home

Slab leaks are a big problem for homeowners. They can damage your home’s foundation and pipes. Your water damage insurance might help protect you from these hidden dangers.

What Constitutes a Slab Leak

A slab leak happens when pipes under your home crack or break. These leaks can be caused by:

- Pipe corrosion

- Ground shifting

- Extreme temperature changes

- Poor initial pipe installation

Common Signs of Slab Leakage

Spotting a slab leak early can save you a lot of money. Look out for these signs:

- Unexplained increases in water bills

- Warm spots on your floor

- Sounds of running water when no fixtures are in use

- Visible cracks in your foundation or walls

Potential Consequences of Untreated Slab Leaks

Ignoring a slab leak can cause serious damage. Leaks can weaken your home’s structure. This can lead to expensive repairs that might not be fully covered by insurance.

“Early detection is your best defense against extensive and costly water damage.” – Home Maintenance Expert

| Potential Damage | Estimated Repair Cost |

|---|---|

| Minor Foundation Damage | $2,000 – $6,000 |

| Moderate Structural Issues | $6,000 – $15,000 |

| Extensive Structural Repair | $15,000 – $50,000 |

Knowing about slab leaks helps you protect your home. It also helps you understand your water damage insurance better.

Does Homeowners Insurance Cover Plumbing Leaks Under Slab

Understanding your homeowners insurance for slab leaks can be tricky. Your policy might cover some plumbing leak scenarios but not all. The coverage for slab leak insurance claims depends on the damage’s cause and situation.

Insurance companies look at the origin and suddenness of the damage when checking slab leak coverage. Usually, your policy will cover leaks caused by sudden and accidental events. Homeowners insurance policies often protect against specific dangers that might damage underground pipes.

- Covered scenarios typically include:

- Sudden pipe bursts

- Unexpected water line breaks

- Accidental pipe ruptures

- Non-covered scenarios often involve:

- Gradual wear and tear

- Long-term pipe deterioration

- Maintenance-related issues

Your plumbing leak deductible is key in figuring out what you’ll pay out of pocket. Some policies make you pay a certain amount before they cover anything. It’s important to review your policy well to know what you might have to pay.

Being proactive and catching leaks early can help a lot with your insurance claim. If you find a leak, document it right away and talk to your insurance about what they can cover.

Covered Perils for Slab Leak Insurance Claims

When water damage hits your home, knowing your insurance is key. Homeowners insurance can help with many water damage causes. But, not all water issues are covered.

What’s covered depends on the situation. The main thing is if the damage was sudden and accidental.

Sudden and Accidental Damage Protection

Insurance usually covers sudden water damage. This includes:

- Burst pipes within walls or under foundations

- Unexpected pipe ruptures

- Rapid water discharge from plumbing systems

Burst Pipe Insurance Scenarios

Burst pipes can lead to big insurance claims. The most common reasons include:

- Pipes breaking from freezing

- Sudden pipe ruptures from internal pressure

- Unexpected plumbing system failures

Natural Disaster Related Coverage

Some natural events might also be covered. This includes:

- Damage from tornados

- Sudden structural collapses

- Water intrusion from extreme weather conditions

“Not all water damage is created equal in the eyes of insurance providers.” – Insurance Industry Expert

Always check your policy to know what’s covered. Insurance rules can differ a lot.

Common Exclusions in Slab Leak Coverage

It’s important for homeowners to know what their insurance covers. Not all slab leaks are the same, and your policy might not cover all water damage. Knowing what’s not covered can help protect your home and money.

Some scenarios are not covered by your insurance. Your policy will likely not cover the following:

- Foundation issues from natural settling

- Gradual wear and tear

- Structural damage from ground movement

- Damage caused by tree root pressure

- Earthquakes and ground shifts

Insurers often don’t cover damages they see as preventable. Slow leaks, constant moisture, and changes in the structure over time are usually not covered. This is because they are seen as maintenance issues.

| Excluded Cause | Reason for Exclusion |

|---|---|

| Gradual Foundation Shifts | Considered normal property aging |

| Continuous Pipe Leakage | Viewed as maintenance failure |

| Tree Root Damage | Preventable with proper landscaping |

Keeping up with maintenance is key to avoiding coverage gaps. Regular checks, quick fixes, and knowing your policy can help avoid big costs from slab leaks.

Understanding Your Insurance Policy’s Water Damage Coverage

Understanding your water damage insurance policy can be tough for homeowners. Your coverage for water damage from pipes isn’t always clear. It’s key to know the details to protect your home.

To keep your home safe from water damage, you need a good insurance plan. Water damage can happen in many ways. So, it’s important to know what your policy covers.

Types of Water Damage Protection

- Standard water damage coverage usually includes:

- Sudden and accidental pipe bursts

- Water damage from inside plumbing failures

- Damage from appliance malfunctions

- But, some things aren’t covered, like:

- Gradual water damage

- Sewage backups

- Flood-related damages

Coverage Limits and Deductibles

Your policy has limits on how much it will pay for water damage. Coverage usually ranges from $5,000 to $50,000. Deductibles can vary widely, from $500 to $2,500.

Additional Coverage Options

There are extra protections you can add to your policy. Consider these options:

- Sewer line endorsements

- Extended water damage protection

- Flood insurance add-ons

Make sure you understand your water damage coverage. Talk to an insurance expert to know what’s missing. This way, you can make smart choices about your coverage.

Cost Factors in Slab Leak Detection and Repair

Homeowners need to know the cost of slab leaks. Finding and fixing these hidden water issues can be pricey. The price depends on several important factors.

Slab leak detection costs range from $150 to $600, with most paying about $280. Repair costs are much higher, averaging around $2,300. Your plumbing leak deductible is key in covering these costs.

- Leak Detection Costs: Typically $150-$600

- Repair Expenses: Average around $2,300

- Factors Affecting Cost:

- Location of the leak

- Extent of water damage

- Repair method required

Your hidden water damage coverage can help a lot. The repair method greatly affects the cost. You have three main options:

- Spot repair (least expensive)

- Partial pipe replacement

- Complete pipe rerouting (most expensive)

It’s important to check your insurance policy. This way, you know what’s covered and what you might have to pay for. Regular checks and maintenance can also reduce repair costs and protect your home’s foundation.

Pro tip: Always document any signs of leaks and contact your insurance provider early.

Filing a Successful Slab Leak Insurance Claim

Dealing with slab leak insurance claims can be tough for homeowners. Knowing the right steps can make it easier and boost your chances of getting coverage.

When you think you have a slab leak, act fast and stay organized. How you handle your insurance claim can greatly affect the outcome.

Documentation Requirements

Good documentation is key to a successful claim. Make sure you have these important items:

- Detailed photos of the leak and damage

- Reports from professional plumbers

- Quotes from licensed contractors

- Records of your home’s plumbing maintenance

Working with Insurance Adjusters

Insurance adjusters are important in checking your coverage. Get ready for their visit by:

- Collecting all needed documents

- Creating a timeline of when you found the leak

- Telling them everything about the damage

- Asking about your coverage

Timeline for Claims Processing

Knowing the claims process helps you plan. Here’s what you might expect:

| Claim Stage | Estimated Duration |

|---|---|

| Initial Claim Submission | 1-3 days |

| Adjuster Investigation | 3-7 days |

| Claim Decision | 1-2 weeks |

| Repair Authorization | 1-2 weeks |

Pro tip: Keep talking to your insurance company during the slab leak claim process to speed things up.

Preventive Measures and Maintenance Tips

To keep your home safe from water damage, it’s important to take care of your water pipes. Regular checks and smart steps can stop costly damage claims.

Here are some key steps to take:

- Schedule annual professional plumbing inspections

- Monitor water pressure and unusual sounds in pipes

- Check for early signs of water damage

- Invest in advanced leak detection technologies

Today, there are new ways to protect your home. Smart water monitoring systems can spot tiny leaks early. These systems connect to your plumbing and send alerts to your phone.

Climate and soil affect your pipes too. Places with dry clay or big temperature changes need more checks. Homeowners should:

- Insulate pipes in cold areas

- Check foundation drainage systems

- Keep soil moisture steady around the foundation

By following these tips, you can lower the chance of water damage. This might even save you money on insurance.

Conclusion

Knowing how homeowners insurance covers plumbing leaks under slab is key to protecting your home. Your water damage insurance policy can be a big help when pipe problems pop up. But, knowing how to handle claims is important.

Homeowners who act early can avoid many problems. Regular checks, watching water bills, and keeping your plumbing in good shape are smart moves. These steps can save you money and trouble with your insurance.

It’s important to review your insurance policy to see what it covers for slab leaks. Every policy is different. Knowing what your policy includes can help you avoid big financial losses. Talk to your insurance agent to make sure you’re covered right.

Being informed and ready is the best way to face slab leaks. Understand your insurance, take care of your home, and act fast if you see any water issues. This way, you can protect your home and your wallet.